Lessons I Learned From Tips About How To Become Financially Literate

The reality is that the united states is 14 th in the world in financial literacy with 57% of adults being considered financially literate, according to the s&p global financial literacy survey.

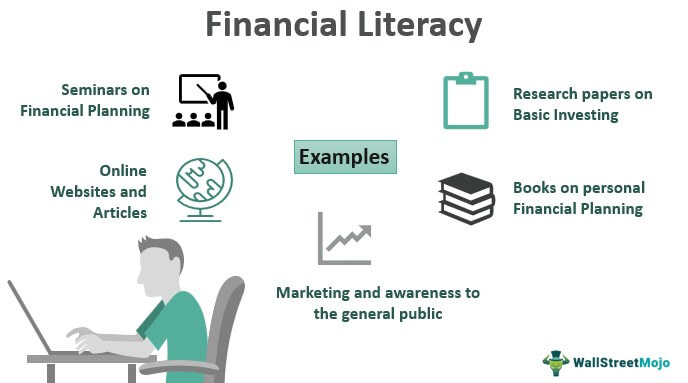

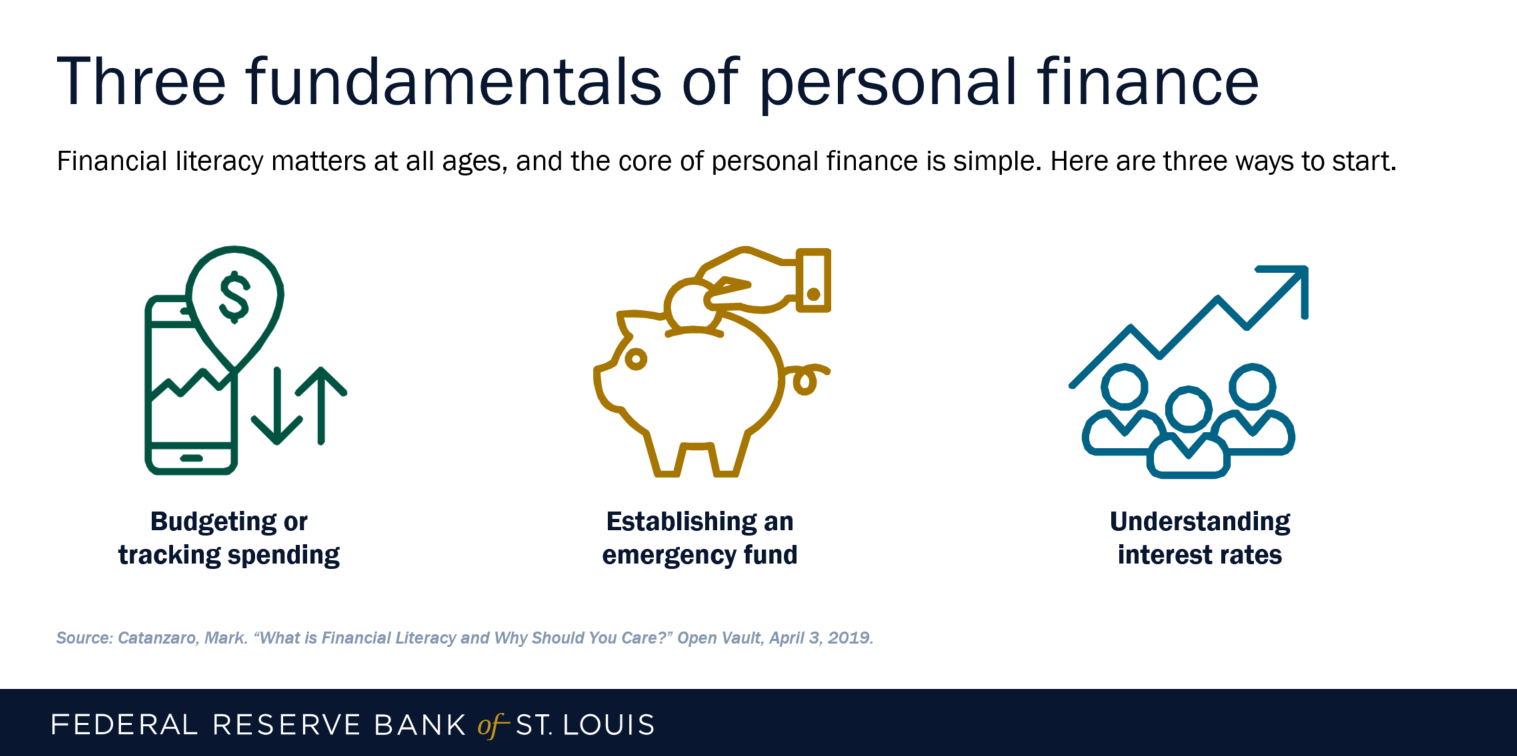

How to become financially literate. Financial literacy refers to the ability to understand and apply financial management skills like investing and budgeting. This sounds an awful lot like a budget. Some of the components that should be learned to ensure favorable.

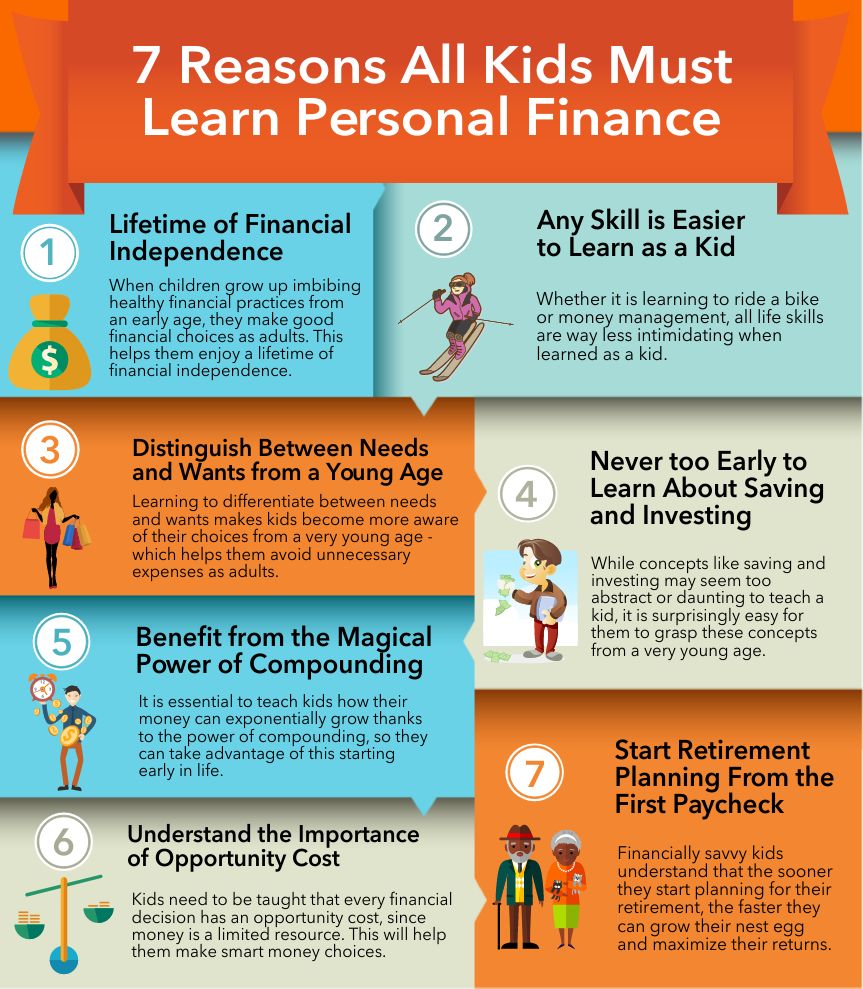

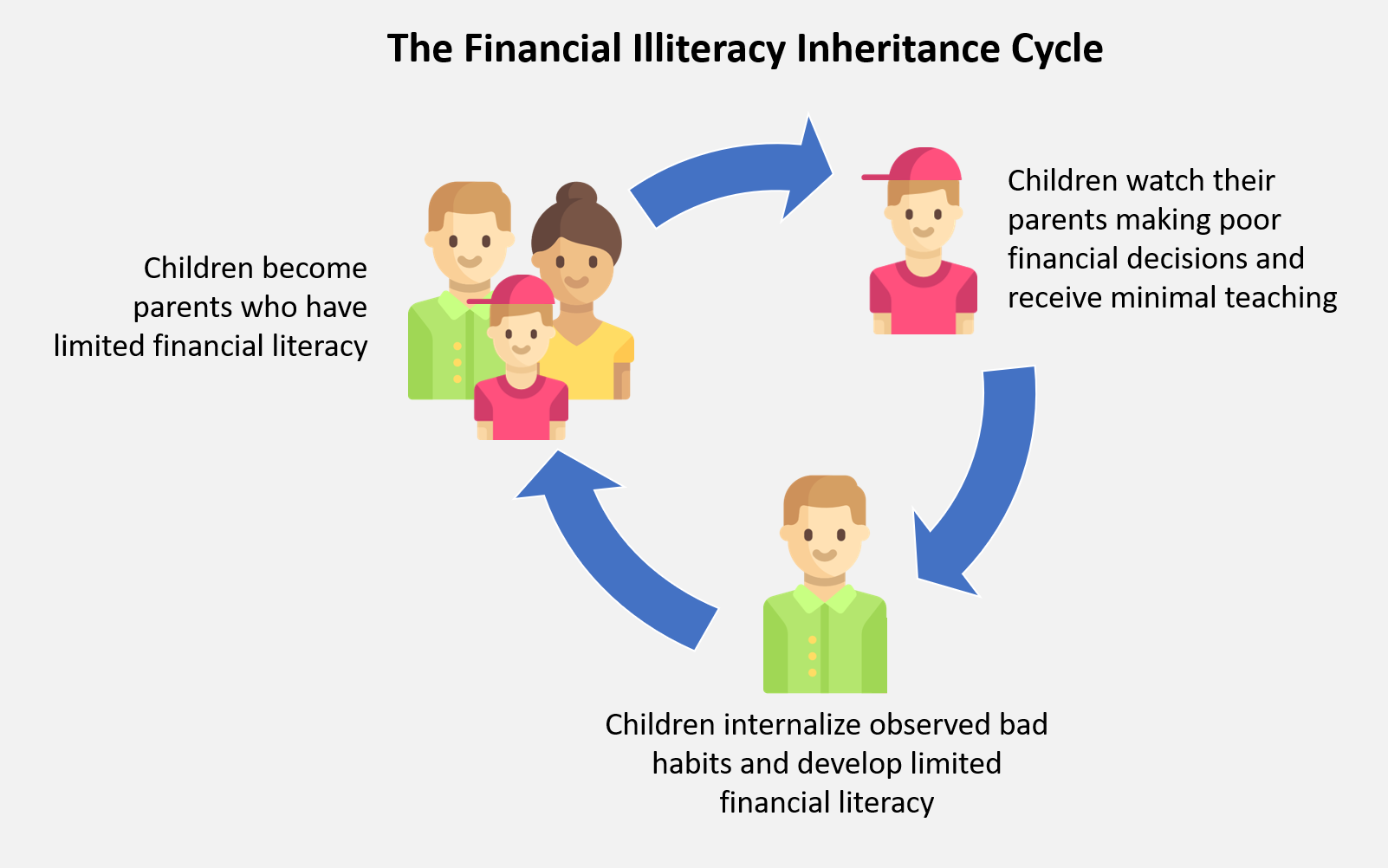

Becoming financially literate doesn’t happen overnight, so don’t feel overwhelmed if you’re just starting to make some changes. There are only two ways to become financially literate. This sounds an awful lot like a budget.

Tap into our free educational resources on personal finance today. Simply put, financial literacy is understanding your ». Know how much money you have coming in, how much.

There are few simple steps you can make right now to. If you are a new investor and on. Steps 1 become familiar with your household finances.

#shorts #finance #loanofficer #realestate #realtor #marketupdate #market #homebuying #recession #orangecounty #calirealestate #youtubeshorts #youtube #loan Many of those rules are shown on government sites as they are constantly updated. Becoming financially literate means that you are able to stick to a budget, while saving for the future, paying down debt and delaying gratification.

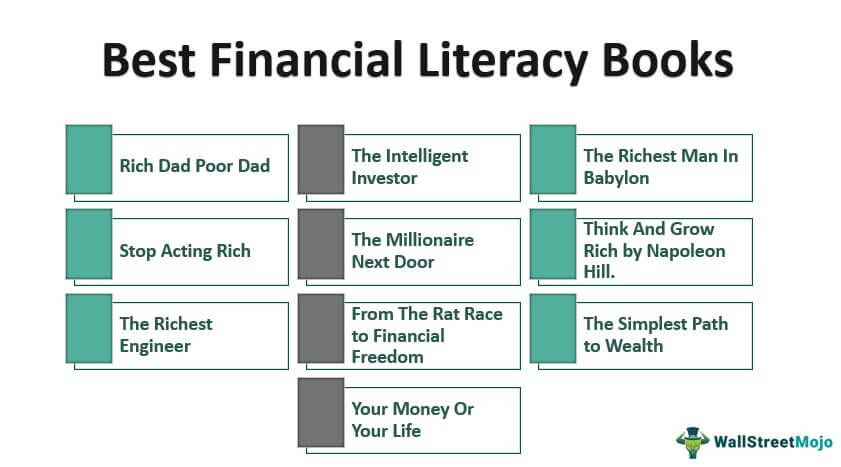

In this blog, we will learn about financial literacy, why it is important, and how to become a financially literate person. To start improving your financial literacy, the first step is to start reading everything about money. Pay off your debts as fast as you can.